jersey city property tax abatement

Cleveland Mayor Justin Bibb and city council are embarking on an overhaul of the citys tax break program for new and renovated housing. If your condo qualifies for tax abatement in jersey city do you pay the property taxes in entirety and then get a refund or do you pay the lower.

New Tower With Community Benefits Approved For 25 Columbus Drive Jersey Digs

The two forms must be filled out yearly on or before March 1st.

. I received the letter from Jersey City 2021 abatement service charge liability. The expanded Tier 4 includes areas of the city deemed most in need of development and continues to allow for the longest tax exemption. A request for abatement must be in writing.

To request abatement you must submit the following. Caused them to end the tax abatement for the property. The new proposal is meant to direct development toward underinvested neighborhoods.

The Jersey City Municipal Utilities Authority resolution of January 20 1983 states that all sewerage abatements must be reviewed resubmitted and approved every year. ACH Direct Debits do not incur a fee. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

The City Council will introduce an ordinance revoking a 20-year tax abatement on a five-story residential building under construction at 305 West Side Ave. Jersey City Mayor Steven Fulop has announced that the city will move forward with the termination of a tax abatement for four of the six buildings within The Beacon Community at 20 Beacon Way. Press J to jump to the feed.

ACH Direct Debit Application. Property tax and Abatement. Urban Enterprise Zone Property Tax Abatement.

Urban Enterprise Zones UEZs are created with the goal of stimulating economic activity in distressed areas. Abatements are a structural portion of Jersey Citys budget ie. City officials said inactivity and unsafe conditions at 305 West Side Ave.

They are baked into the budget each year in significant amounts comprising 18 of total revenues in 2021. While schools receive a portion of regular property tax they do not receive any of the PILOT fees. JERSEY CITY Mayor Steven M.

I bought the condo in Jersey City NJ and received the mortgage interest statement from the lender. Line 10 Other real property taxes paid 500. The city has long offered 15-year full property tax abatements for newly built or substantially renovated housing.

5227H-60 et seq and shall include the entire area withi n. Under the new proposal the city would abate taxes only on the first 350000 of a homes value. Jersey City abatements have historically sent 95 of the PILOT fees to the city 5 to the county and 0 to the schools.

Find a sellers agent. This law provides for five-year tax abatements to existing and newly constructed residential properties and non-residential structures converted to residential use in. As set forth in Executive Order 2015-007 the revised program is intended to build on the success of the current PILOT program and instill greater transparency objectivity uniformity and predictability and to better employ the.

Jersey City will terminate the tax abatement on four buildings within the Beacon residential complex after ownership defaulted on an obligation to. 5 Year Tax Abatement - Jersey City NJ Real Estate. My previous post in this series looked at the most recently available abatement data from the 2021 user friendly budget.

294 Griffith St 2 Jersey City NJ 07307. City of Jersey City. You can check that out here.

1 day agoUnder a new proposal Cleveland would offer different levels of residential tax abatements depending on the strength of the local real estate market. You should send your request for abatement to the address listed on your billing notice. Jersey City Home values.

Annual Year Income Statement for qualifying Seniors PD 65 Note. Of comparatively high property tax rates in New Jersey abatements can be a valuable incentive for developers involving hundreds of millions of dollars in abated taxes on billions of dollars of property across the state. Reena Rose Sibayan The.

The latest iteration of Jersey Citys tax abatement policy retains the tiered structure while making minor tweaks to the policy. While abatement of taxes otherwise owed is uniformly positive from the perspective of the. New Jersey Property Tax Benefits.

This the most direct impact that abatements have on our schools but more is explained below. Online Inquiry Payment. Bundle buying selling.

Pursuant to the New Jersey Urban Enterprise Zones Act PL1983 c. Press question mark to learn the rest of the keyboard shortcuts. 2 hours agoMayor Justin Bibbs administration along with Cleveland City Council President Blaine Griffin unveiled Monday the proposed changes to the citys much-discussed property tax abatement policy.

Jersey city property tax abatement Saturday March 19 2022 Edit Jersey City Public School which educates about 30000 students at its peak received 4187 million in state aid for the 2016-2017 school year but it will have seen more than 2336 million. No abatements will be renewed until all the forms and requested material is received and a. The city has long offered 15-year full property tax.

For instance Tier 1 provides a tax-abatement term of 10 years and requires. Abatements can only be granted once a penalty has been assessed and the taxpayer is notified billed. Abatement applications must be completed in full with the appropriate fees included.

Jersey Citys new tax abatement policy also includes new affordable housing requirements which is tied to the length of the abatement. It cannot be granted in person by phone or through email. Taxes are levied pursuant to chapter 4 of Title 54 of the.

APPLICATION FOR REAL PROPERTY TAX ABATEMENT FOR RESIDENTIAL PROPERTY IN AN URBAN ENTERPRISE ZONE CHAPTER 207 PUBLIC LAWS 1989 as amended. Daniel Hubbard Patch Staff Posted Tue Nov 12 2019 at 222 pm ET. Fulop announced today the city is moving forward with the termination of a tax abatement for 4 of the 6 buildings within The Beacon Community located at 20 Beacon Way after the developer Baldwin Asset Associates Urban Renewal Company Baldwin defaulted on its 2005 financial agreement with the City of.

2021 second half service charge liability payment in lieu of taxes. Buy and sell with Zillow 360. New Yorkers gain several forms of relief from NYC property tax thanks to a mix of tax abatement programs like the J51 Tax Abatement the Cooperative and Condominium Abatement the Green Roof Abatement the Solar Roof.

Senior Freeze Property Tax Reimbursement. Instructions on How to Appeal Your Property Value. Additional rules would direct more abatement.

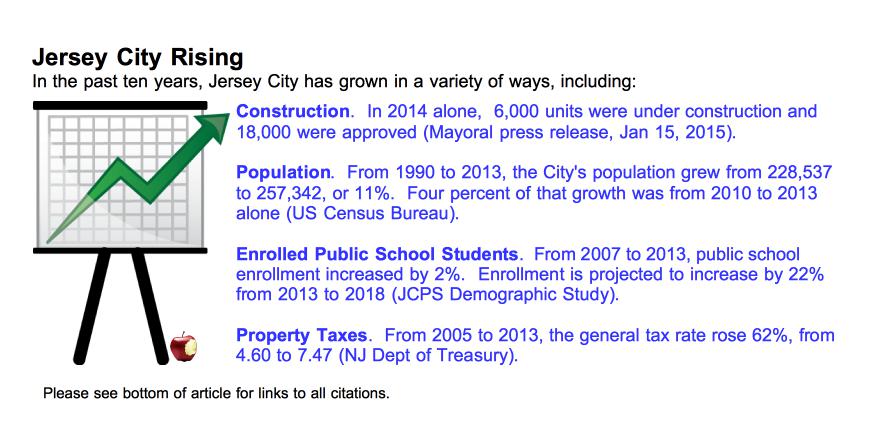

Jersey City Rising Civic Parent

Peek Inside Park And Shore Jersey City S Ultra Luxury Condo Development Luxury Condo Apartment Interior House Prices

Why Taxes Are Rising In Jersey City Civic Parent

5 Year Tax Abatement Jersey City Real Estate 14 Homes For Sale Zillow

Jersey City Abatement Policy Civic Parent

Jersey City Abatement Policy Civic Parent

Tax Abatement Until 2040 Crystal Point Two Bed Condo Offers Every Luxury And Value Jersey Digs

Jersey City S New Tax Is An Unconstitutional House Of Cards Lawsuit Says Nj Com

Jersey City Homes For Sale Turks And Caicos Real Estate Turks Caicos Sotheby S International Realty

5 Year Tax Abatement Jersey City Real Estate 14 Homes For Sale Zillow

Jersey City To Terminate Tax Abatement With The Beacon Hudson Reporter

In One Chart Jersey City S Seismic Change In Tax Levies Fully Funds The Schools And Reallocates Property Tax Civic Parent

Mapping Jersey City S Abatements By Project Type And Ward Civic Parent

Trump Plaza Jersey City New Jersey

Audit Report Jersey City Boe Lost Out On Millions Due To Inaccurate Pilot Billings Hudson County View

Map See Where Jersey City Hands Out Tax Abatements Nj Com

Abatements Put On Pause Hudson Reporter

Impact The Gold Coast Spreads Inland Hudson Reporter

Jersey City To Audit Hundreds Of Tax Abatement Agreements Njbiz